Research:

Financial wellness programs at work

Supporting employee well-being and financial security in times of uncertainty.

Introduction

The recession shadow looms over employees in the U.S., who are putting in the same amount of work for reduced purchasing power. With inflation outpacing wage rises, the cost of living blowing up, and pension plans in decline, financial insecurity is deepening.

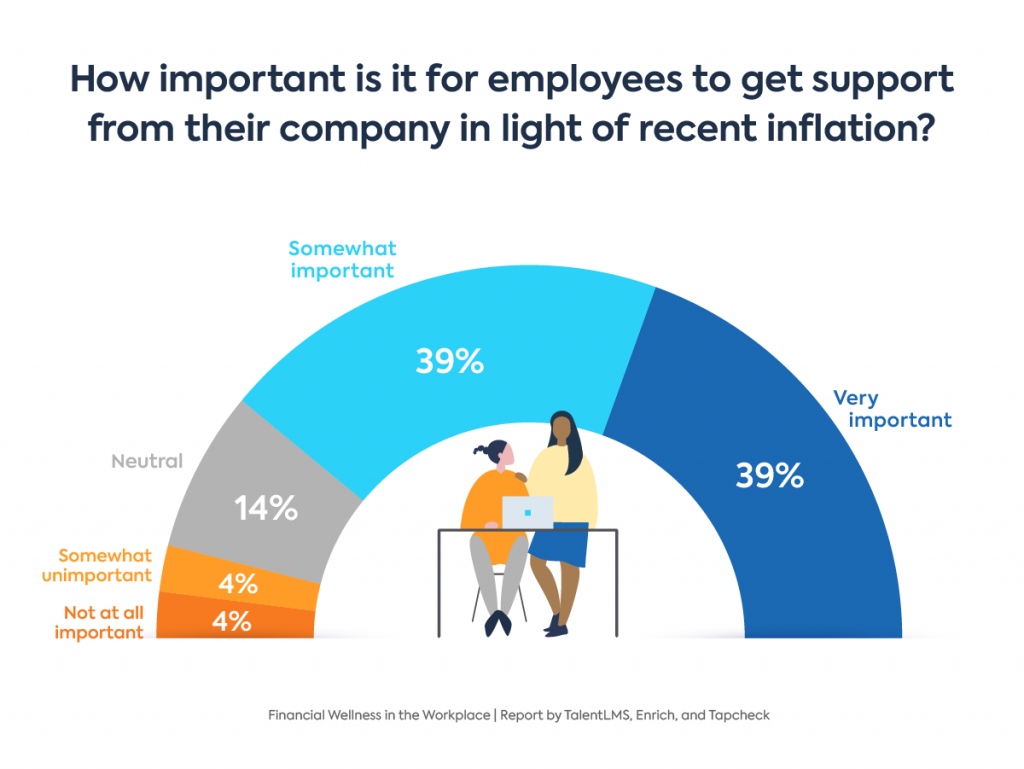

Employees’ financial well-being is for the most part dependent on their employers, who are in the perfect position to help. Employees also think so, with 78% desiring support from their employers due to inflation. But, are companies doing enough?

New research by TalentLMS, Enrich, and Tapcheck zooms into financial wellness programs in the workplace: Are employees getting them, are those programs helpful, and is the offer aligned with employees’ needs? The survey of 1,000 employees in the U.S. across industries also took the pulse of money-related views between four working generations, and highlighted areas of alignment and contrast between Gen Z, Millennials, Gen X, and Baby Boomers:

-

The toll of financial stress on different generations of employees

-

How are employees coping with financial insecurity?

-

Spending cuts employees have made because of inflation

-

What employers can do to support the financial health of their people

-

Financial wellness benefits: Unlocking financial security

-

Financial wellness training: Improving everyday life

-

Retirement planning: Heading toward a secure financial future?

The data unveiled that employees want advice, guidance, and resources from their companies to help them offset the rising cost of living. Research findings unpack how employers can take better financial care of their employees and give rise to a supportive and caring workplace.

Key findings

-

Only 5% of employees say they have met their financial goals. Out of those who didn’t meet their goals, inflation (62%) and insufficient income (48%) are the two main obstacles in reaching them.

-

In light of inflation, 78% of employees find it important to get support from their company.

-

Due to money-related stress, 49% of employees have experienced mental health struggles, and 45% have physical health issues.

-

68% of employees are more likely to stay longer at their current job if their employer offers them financial wellness benefits.

-

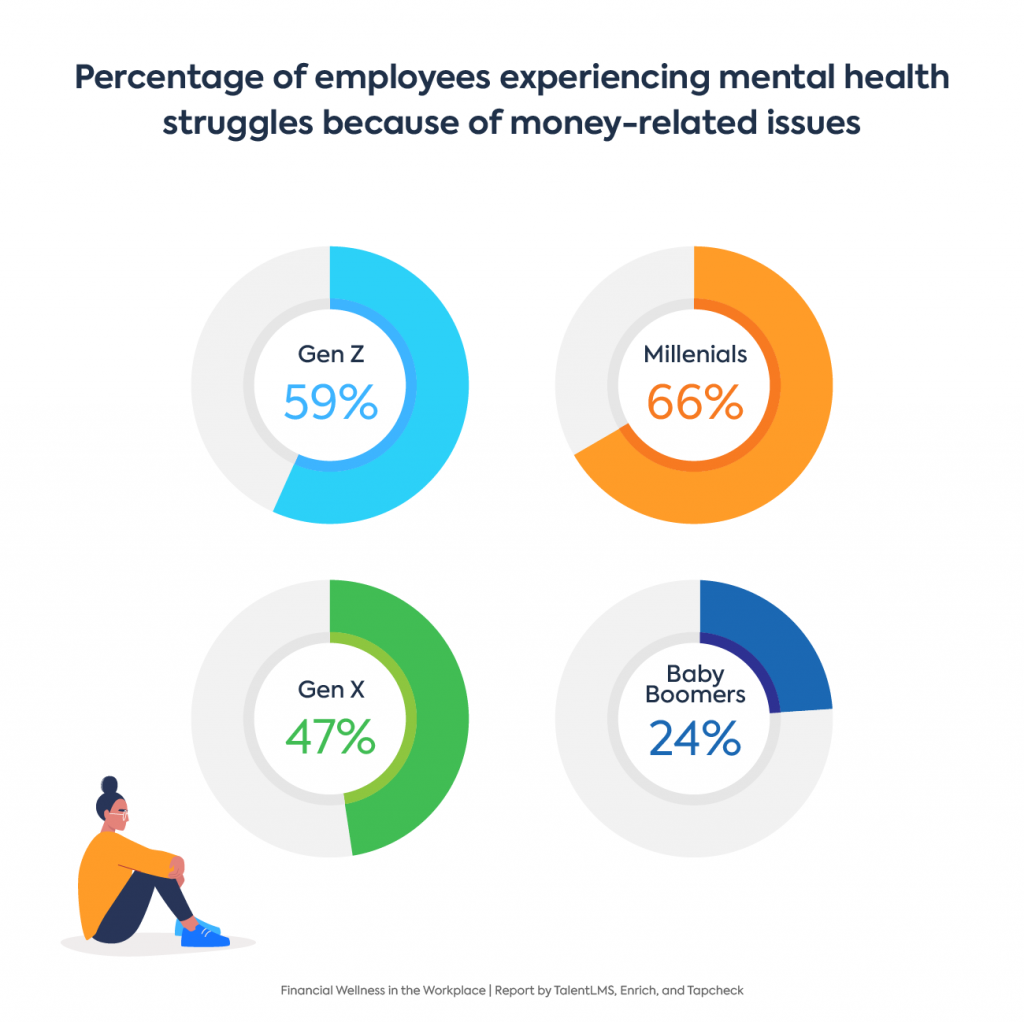

66% of Millennials, 59% of Gen Z, and 47% of Gen X employees have experienced mental health struggles due to money-related issues.

-

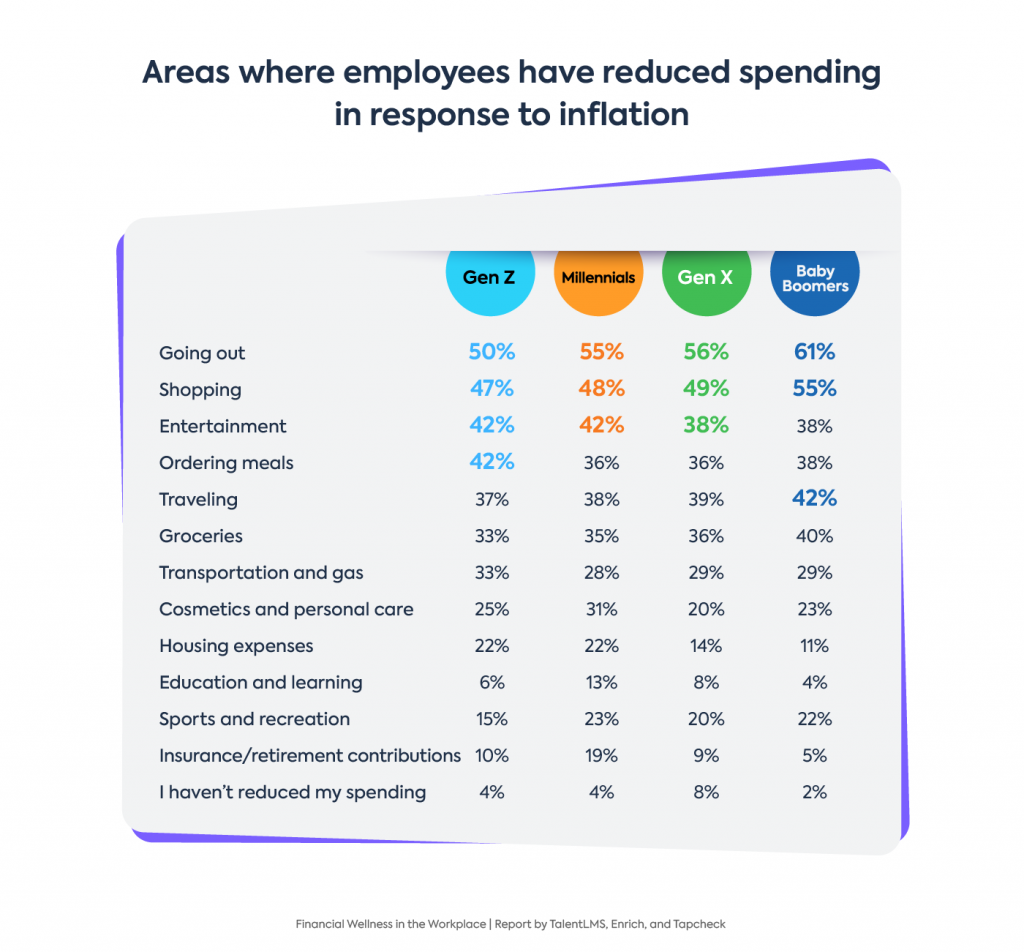

Going out, shopping, and entertainment are the three main areas where employees have reduced spending in response to inflation.

-

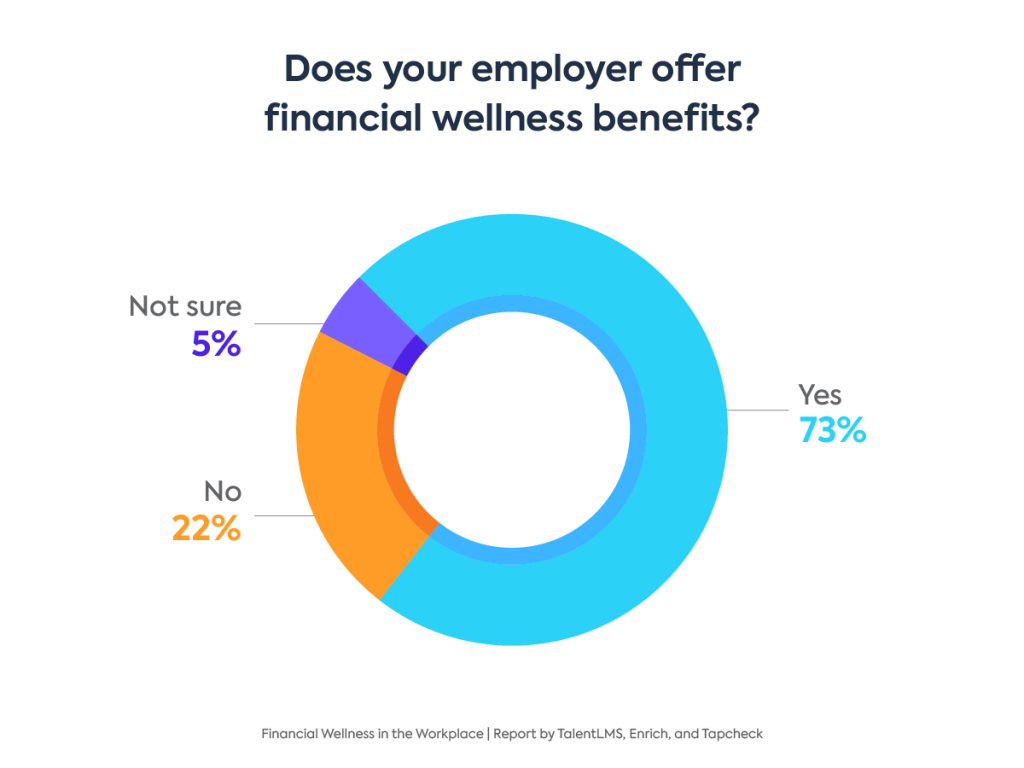

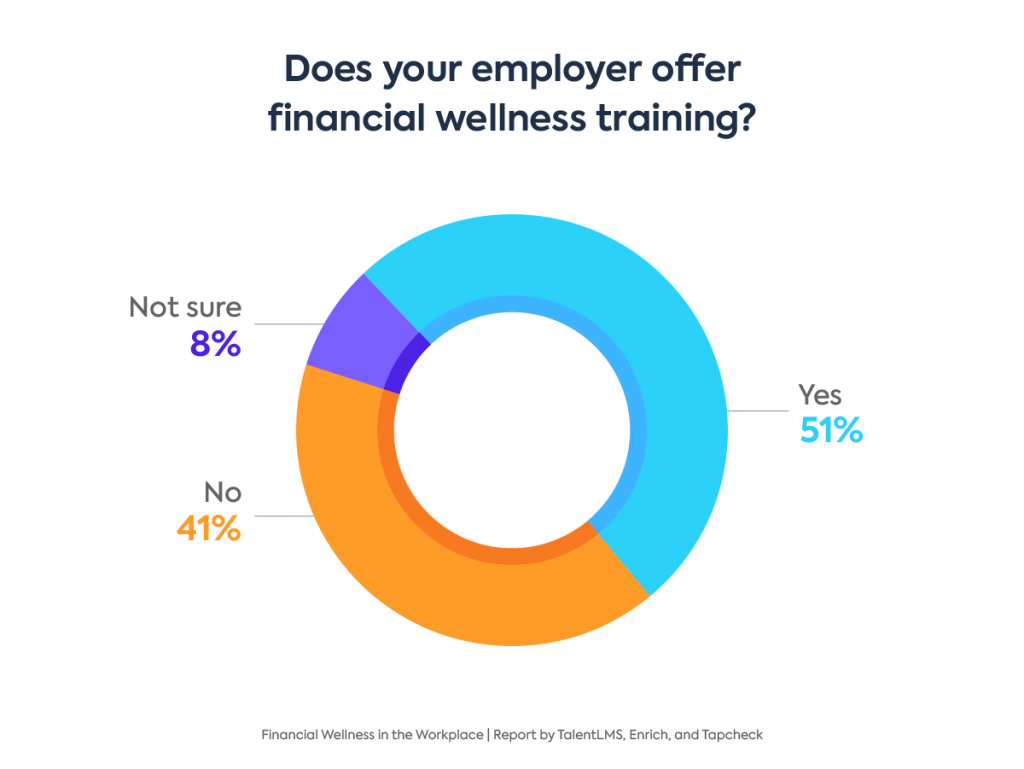

73% of employees are getting financial wellness benefits from their employer, while 51% are receiving financial wellness training at work.

-

1 in 4 employees would like to be financially prepared to retire before they turn 50. But less than half (49%) feel they are on track to meet their financial goals and retire by the desired age.

-

Recession talks have made 7 in 10 employees more concerned about their financial wellness.

-

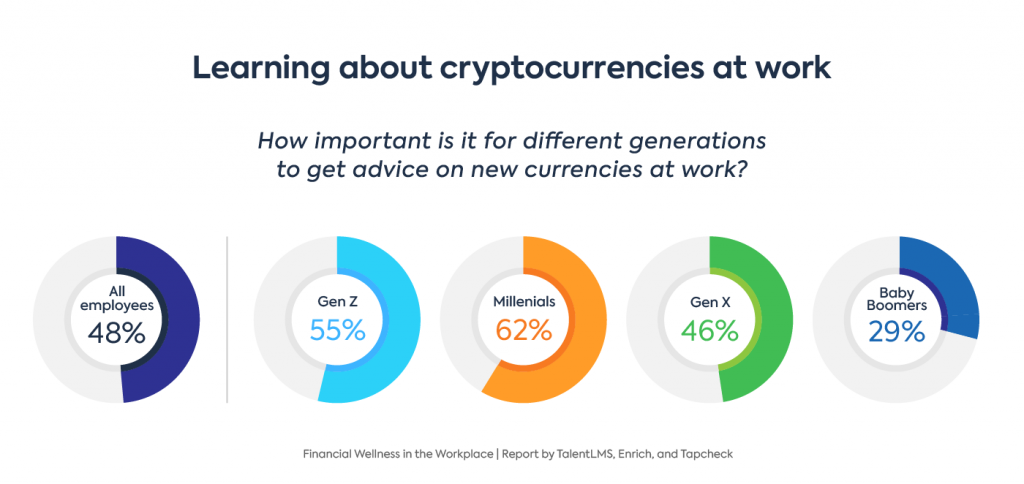

Getting advice from their employer on cryptocurrencies is important for 48% of employees.

-

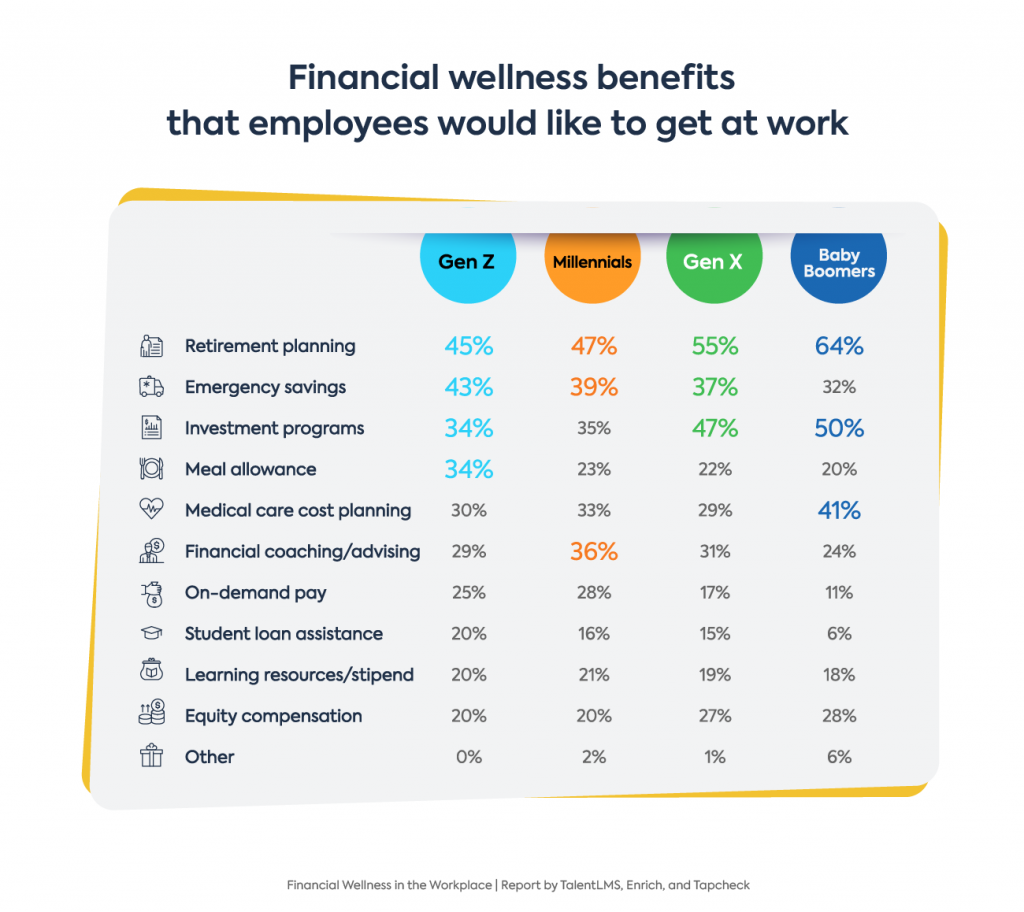

The top three financial wellness benefits employees would like to receive from their employer are retirement planning, investment programs, and emergency savings.

-

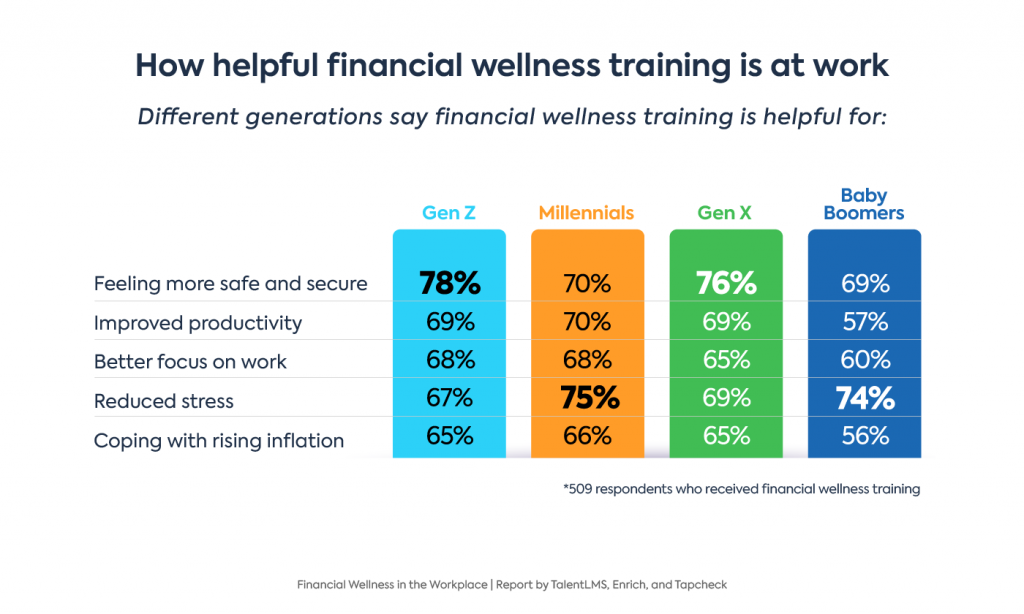

73% of employees who are getting financial wellness training from their company say it is helping them feel safer and secure.

-

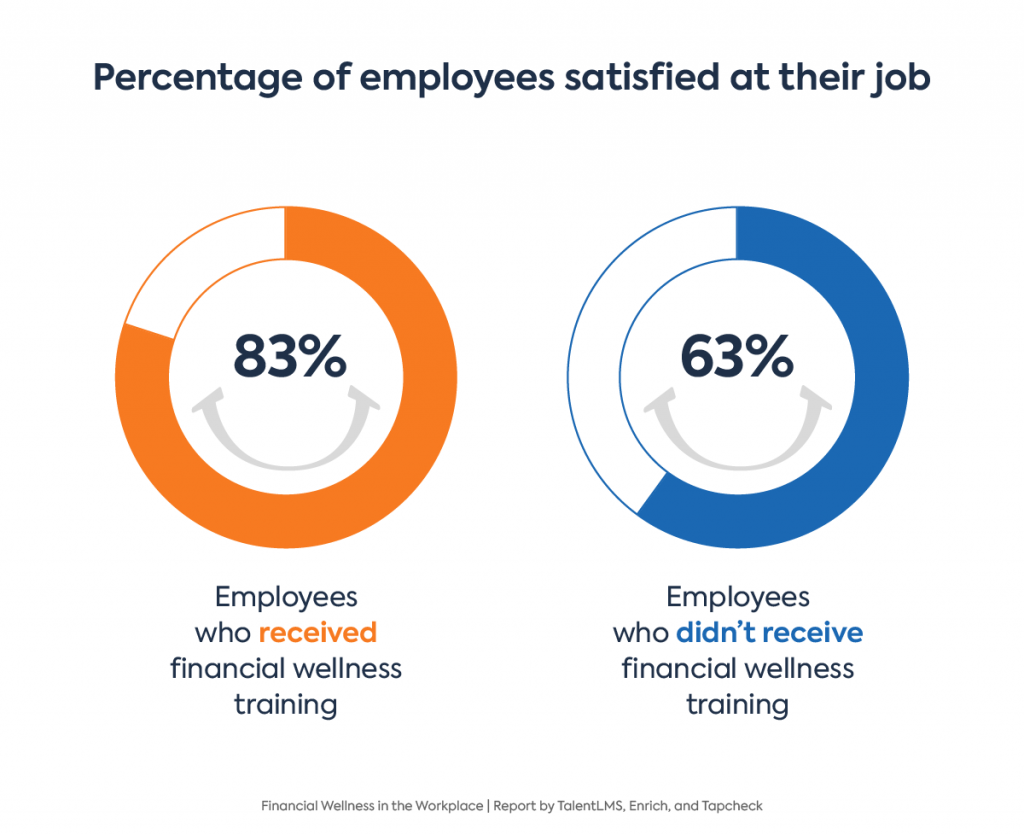

Financial wellness training improves job satisfaction: 83% of employees who got it are satisfied with their job, as opposed to the satisfaction rate of 63% who did not receive training.

The toll of financial stress on employees

Financial pressure on employees is piling up. Bank of America reports that 62% of workers are stressed about their finances, and almost half are worried that they won’t be able to make ends meet because of inflation. Our research confirms this sentiment, with 7 in 10 employees saying they are more concerned about their financial well-being due to recession talks, while less than half feel financially stable. What’s more, the findings uncovered that financial worries are creating mental and physical health issues.

Money-related stress causes mental and physical health struggles

Nearly half of surveyed employees (49%) have experienced mental health struggles because of money-related stress. When money and mental health challenges are intertwined, one problem can build upon the other — creating a vicious loop of anxiety that can be difficult to break out of.

Besides worsening mental health, financial stress also takes a toll on physical health: Money-related stress is creating physical health issues for 45% of employees.

With financial worries having a devastating effect on the mental and physical health of employees, it is clear that they need help to break out of the anxiety loop and restore a sense of security.

The uneven impact of money-related stress on different generations: Millennials are affected the most

The survey results showed that financial stress runs deep for most generations. But for some, it runs deeper.

Looking into how different age groups at work are coping with money stress, data revealed that Millennials suffer the most: 66% of Millennial employees have experienced mental health struggles due to money-related issues. On the other hand, older employees seem to control their financial anxiety somewhat better, with 24% of Baby Boomers saying their mental health is impacted by it.

When it comes to how money-related stress impacts physical health, Millennials are again the most affected generation, with 56% enduring physical health difficulties because of financial concerns. While Gen Z (51%) and Gen X (50%) follow closely, Baby Boomers are again the least affected age group, with 27% agreeing that money-related stress causes them physical health issues. Yet all ages are heavily burdened with financial stress, which harms their mental and physical health.

On their own: Battling the exploding costs by spending less

Employers are failing to match the inflation rate with wage raises: Gartner found that only 13% of organizations intend to increase employee pay due to inflation. Without substantial support in the face of exploding life costs, employees are doing whatever they can to weather the storm. And their main strategy is to put the brakes on spending.

The majority of employees, across four working generations, cope mainly with financial insecurity by spending less and saving more. The next coping strategy is learning to manage finances better, followed by looking for a new job that pays better.

To keep up with a squeeze on incomes, employees are making sacrifices. With only 7% saying they have not reduced spending, let’s look at which expenses are being slashed.

The first thing employees are giving up is going out, with 56% reducing how much they spend in bars, cafes, and restaurants. The next category, where 50% of the workforce has tightened their belt, is shopping, followed by entertainment, with 40% cutting how much they spend on streaming, gaming, and music.

Zooming into how different generations approach spending cuts, data unveils alignment across different age groups. No matter the age, going out and shopping are taking the biggest hit.

Financial wellness programs at work: A remedy for stress and a path toward financial security

Economic upheaval is forcing employers to rethink their role in supporting the financial health of their people, heavily impacted by unrelenting inflation.

Companies seem aware of their responsibility, along with the benefits of a financially fit workforce: 95% feel responsible for employees’ financial wellness. And 98% agree that employee financial wellness has a direct impact on their organizations, most commonly on productivity, engagement, and turnover.

What employers can do to support the financial health of their people

Survey data uncovered that companies are not supporting their workers substantially. Only 45% of employees agree that their employer is doing enough to improve their financial wellness. This is more encouraging than what Gallup recently found, that fewer than 1 in 4 U.S. employees feel strongly that their employer cares about their well-being. Either way, there’s a lot of room for improvement in the current state of monetary incentives and financial support that are offered to workers.

Employers should take note that looking for a higher-paying job ranks third on the list of inflation-coping strategies, especially in light of unemployment rates staying low despite job cuts. Regardless of headcount reductions taking place, business leaders remain concerned about hiring and retaining talent, PwC reports.

Here are the key takeaways for employers on what they can do to better support the financial health of their people and guide them into a more secure financial future.

Match benefits to dthe ifferent needs of a multi-generational workforce

Getting financial wellness benefits at work is important for 77% of employees. With 73% getting them, there’s still a gap to be closed. But one size doesn’t fit all ,as different age groups need different things.

The majority of employees across generations have chosen retirement planning as the most sought-after benefit. However, delving deeper into the data, contrasts in priorities of different generations have emerged. For example, only Gen Z ranks meal allowances in the top three, while only Millennials picked financial coaching and advising. As for Baby Boomers, they differ from other age groups in prioritizing medical care planning, while in open-ended responses, they expressed the desire for benefits such as commuting funding, job performance reward, and cryptocurrency education and pay.

Moreover, getting guidance from their employer on monthly spending strikes a chord with younger employees, with 62% of Gen Zers finding this important, as opposed to only 37% of Baby Boomers finding it important.

As high as 80% of employees prefer additional benefits over a pay increase. And going a step further and tailoring a benefits package to the specific needs of a multi-generational workforce can level up its value.

Provide training and education on financial literacy and money management

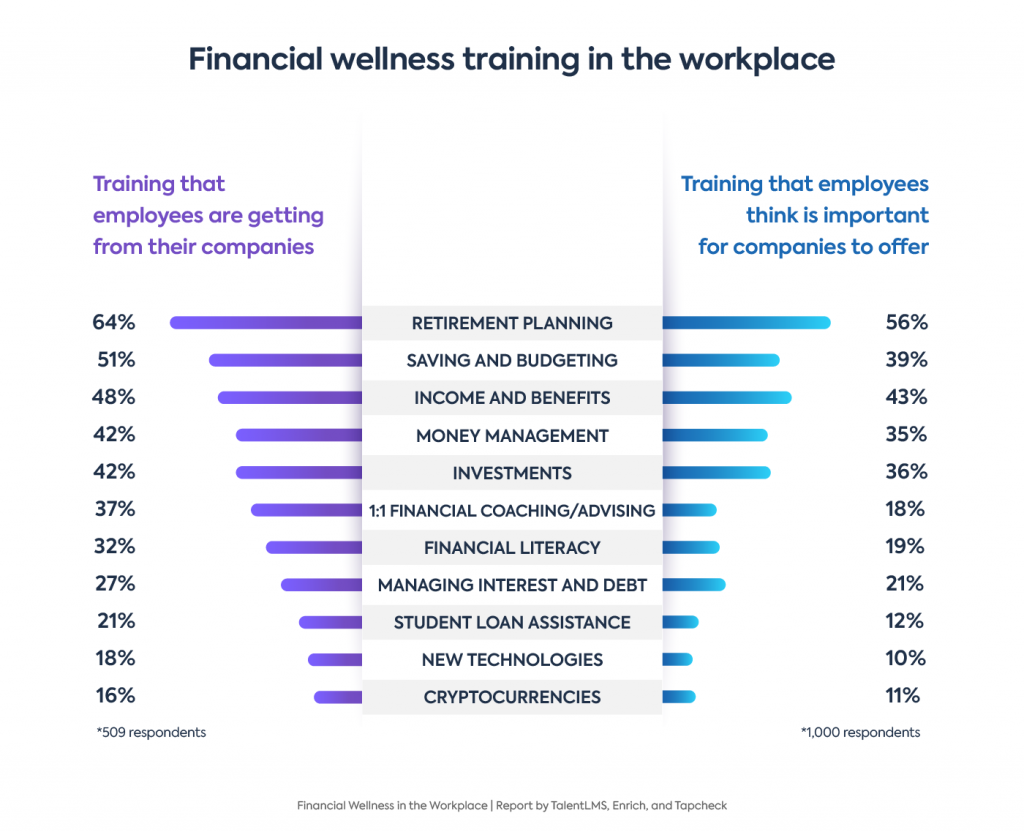

Less than 50% of employees are receiving training on money management at work, while only one-third get training on financial literacy. Though a low level of financial literacy was a top contributor to financial stress and anxiety even before the pandemic, a majority of employees still don’t get the financial guidance they need.

Over two-thirds of employees said that they felt safer and more secure thanks to the financial wellness training they got at work. Improving financial literacy in the workplace can relieve employees from excessive stress and help them create a more positive headspace. Companies can contribute to the financial literacy of their people with a plethora of resources and initiatives, such as courses, coaching, training sessions, apps, and more.

Help employees stay on track with their financial goals

The research unveiled a deep financial insecurity: Less than half of employees (49%) feel they’re on track to meet their financial goals and retire by their desired age. When it comes to what holds them back from achieving goals, inflation tops the list, with insufficient income as a runner-up.

For 37%, coping with debt and high-interest rates are the main obstacles preventing them to reach their financial goals, while for 35% it is maintaining their lifestyle. Whereas not knowing how to manage money properly blocks one-quarter of employees from achieving their goals.

For companies putting emphasis on future readiness, investing in keeping employees financially fit should be a priority. This means offering them resources and tools that can help them understand different aspects of managing their income and coping with inflation, debt, and high-interest rates.

Offer an emergency savings account (ESA)

Emergency savings are among the top 3 financial wellness benefits employees would like to receive from their employer. Among the four generations, Gen Z prioritizes them the most.

Companies can offer a number of ways to support employees in building emergency funds in addition to retirement plans. Some examples are savings programs and dedicated accounts. With Americans pulling money from savings at excessively high rates, emergency savings can be an additional blanket of security that their employers can wrap them into.

Offer earned wage access (EWA)

Over half of the employees (53%) say they’d stay longer in a company because of on-demand pay. Zeroing in on generational differences data, it turns out that Millennials, the largest cohort in today’s U.S. workforce, prioritize this benefit more than other generations and have it in high demand: 72% of Millennial employees are more likely to stay longer at their current job if on-demand pay is offered. Offering earned wage access, or EWA, gives employees better control over their earnings, in addition to helping them make ends meet.

Guide employees into financial longevity

With close to one-third of employees not being on track to meet their financial goals, they need substantial help in reaching lifelong financial security. Several survey findings mirror this sentiment and point to a gap employers should fill.

Though the most frequently offered financial training at work is on retirement planning, with 64% of employees receiving it, plenty of workers are still left without guidance. Offering learning resources and guidance on different retirement plans and investments can unburden employees from worrying about their financial future and give them better control over their pensions.

Resources for the digital age: Tech tools and new currencies

For 48% of employees, it is important to get advice from their employer on new currencies, such as cryptocurrencies and NFTs. However, only 16% of employees receive such training and resources from their employer. This is an opportunity for companies to differentiate and level up their benefits program.

Finally, provide tech tools that’ll help employees navigate their finances better: 7 in 10 find it important to get access to apps and tools that can help them manage their finances.

Financial wellness benefits

Financial wellness programs in the workplace tend to be viewed as a perk for attracting top talent. But they are so much more than that, especially in the current economic storm. Financial wellness programs create an opportunity for employees to turn their hard work into long-term financial wellness, rather than just living paycheck to paycheck.

The data from our research showed that 68% of employees are more likely to stay longer at their job if their employer offers financial wellness benefits. What’s more, they lift job satisfaction: 8 in 10 employees getting financial wellness benefits from their company are satisfied with their job.

These benefits convey a feeling of appreciation to the employees — 83% view financial wellness benefits as a sign that their employer values them and their work.

Unlocking financial security

Employers hold the key to the financial health of their people. They can use financial benefits to create a supportive workplace and unlock the hidden workforce potential. But, despite the growth of financial wellness programs at work, with 73% getting financial wellness benefits, almost 3 in 10 employees still don’t have access to them. Even though getting them is important for 77% of employees.

Promoting physical and mental welfare

Medical care cost planning is within the top 5 most desired benefits for employees. For some, such as those having dependents, it may be the single most important benefit, topping even salary.

Even though health coverage provided by the employer is making a difference in retention as well as in recruiting, due to the rising costs, employers have been reassessing their role in the health care support of their employees. But the research data, as previously shown, has shed light on the negative impact money-related stress has on the physical health of workers. And that’s something employers should factor in.

In addition to sponsoring medical costs, companies can enrich their health benefits programs to include educational resources promoting healthy habits, exercise, and mindfulness.

The most sought-after benefits for each generation

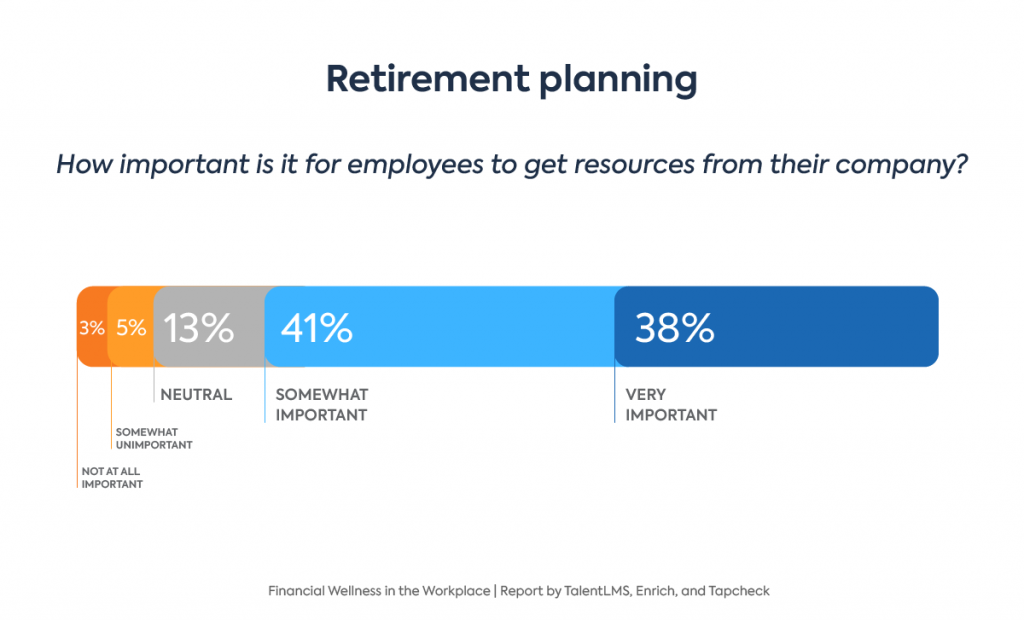

The top 3 financial wellness benefits employees would like to receive from their employer are retirement planning (53%), investment programs (42%), and emergency savings (38%).

As previously seen, retirement is a priority for all generations. However, there are differences in how different age groups prioritize other benefits. For example, for Gen Z, the runner-up is emergency savings (43%), followed by investment programs and meal allowance (34%). Millennials also rank emergency savings in second place, while the third spot differs, with financial coaching/advising (36%) taking it.

Whereas for Gen X and Baby Boomers, investment programs take second place after retirement planning, followed by emergency savings for Gen X and medical care cost planning for Baby Boomers.

Financial wellness training in the workplace

Financial wellness training at work is important to 65% of employees. And it is helpful to almost 7 in 10 in improving focus and productivity at work. However, nearly half of employees are not getting it from their companies.

With 51% of employees receiving learning resources, further data showed that companies are mostly aligned with employees’ needs when it comes to the types of training offered. Along with prioritizing retirement planning, saving and budgeting, and income and benefits, over a third of employees find important investments and financial literacy training.

Improving everyday life with financial wellness training

Workers are eager to get financial wellness support from their companies. But with many living from hand to mouth, their needs are more urgent and current, as opposed to pursuing long-term goals such as retirement planning. They need support here and now.

Coping with inflation is top of mind for many employees, and 64% said financial wellness training helped them cope with it better. The majority also found it helpful for improving productivity (67%), focus at work (66%), and reducing stress (71%).

Furthermore, 53% think it is valuable to get guidance from their companies on monthly spending and saving. At the same time, the majority have cut spending on going out, shopping, and entertainment, but only 10% of employees have reduced spending on education and learning. This highlights lifelong learning as a non-negotiable value. And points out that financial wellness training at work is a must-have, rather than a nice-to-have.

Financial wellness training can be an ally in easing stress and improving the daily lives of workers who are clouded by economic uncertainty. At the same time, it offers tangible benefits to organizations and helps them build a more confident and focused workforce. With 41% of employees not having financial wellness training at work, there’s a lot of room for improvement.

Let’s dive into the specific areas that financial wellness training at work helps with, as found by the surveyed employees who receive it from their companies.

-

Elevating job satisfaction and retention

As much as 61% of employees would stay longer in a company because of financial wellness training. And for those receiving it, satisfaction ranks higher: 83% who got training are satisfied with their job, compared to 63% who did not receive training.

-

Improving focus and productivity

Two-thirds of employees (67%) who received financial wellness training say it helped their productivity, while 8 in 10 said it helped them be more focused at work

-

Combating stress

Financial wellness training is helpful in reducing stress for 71% of employees. This percentage is even higher for Millennial employees (75%), whose mental health suffers the most, as seen previously. Finally, 73% of employees say that the financial wellness training they get at work helps them feel safer and secure.

-

Coping with inflation

Over 6 in 10 employees (64%) getting financial wellness training say it is helpful for coping with rising inflation. Providing financial training courses can help them navigate the overheated economy and income squeeze, where employees hurt the most.

Retirement planning: Heading toward a secure financial future?

Heading toward a secure financial future means that employees can feel at ease and financially safe. While, lack of assurance in this important matter can cause financial anxiety that affects all areas of life, including work. With only 5% of employees saying they have met their financial goals, the majority of the workforce does not seem confident in their long-term financial security.

The TalentLMS, Enrich, and Tapcheck research unveiled a deep need across generations for support in navigating retirement planning. Receiving resources from their employer on retirement planning is important for 79% of employees. Other studies echo this, with employees considering retirement plans to be the most important part of financial wellness.

Another survey finding shows employees are doing their part in securing their pension: In spite of inflation, only 11% of employees have reduced their spending on insurance and retirement contributions.

Ideal retirement age for different generations of employees

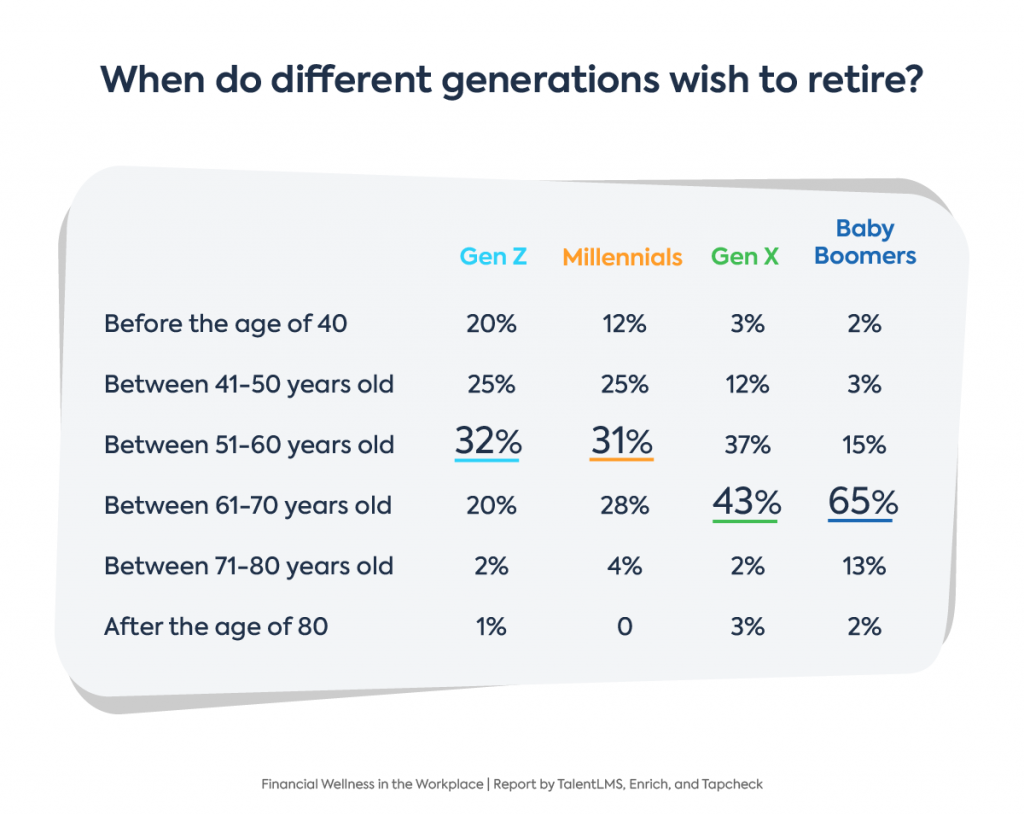

The majority of employees would like to retire when they’re between 60 and 70 years old. What’s interesting to see is that early retirement is quite sought after, with 1 in 4 desiring to be financially prepared to retire before they turn 50.

When breaking this further down per age group, interesting patterns and contrasts emerge, with older employees pushing further the pension limit as they age. For example, 65% of Baby Boomers want to retire when they’re between 60 to 70 years old, but only 20% of Gen Zs say the same. At the same time, 1 in 4 Gen Zs and Millennials would like to retire before they turn 50. Finally, 20% of Gen Z employees would like to be financially prepared to retire before they turn 40.

The need for support in navigating retirement is urgently evident with the largest generation in the U.S. labor force. Two-thirds of Millennials have nothing saved for retirement, and those who are saving aren’t saving nearly enough. According to a previous report by NerdWallet, Millennial grads won’t be able to retire until 75 years old. That clashes with their wishes, as our research found that the majority of Millennials would like to retire between 50 and 60 years old.

Our research also indicates that it may not be possible, as out of four generations, Millennials have made the biggest cut on their insurance and retirement contributions in response to inflation: 19% have reduced them, whereas only 10% of Gen Z, 9% of Gen X, and 5% of Baby Boomers have done the same.

The dream of early retirement will stay just a dream for most, especially women

One in four employees would like to be financially prepared to retire before they turn 50. But that dream does not look feasible for most. Close to 1 in 3 employees don’t feel they are on track to meet their financial goals and retire by the desired age. Additionally, men are more likely to be on target to retire by their desired ages, with 57% saying so, compared to only 41% of women saying the same. This may be pointing to the gender pay gap as one of the possible reasons.

The 2022 Global Pension Index ranked the U.S. pension system in the 20th position on the list of 44 countries, showing U.S. employees are mostly on their own when it comes to securing a safe financial future. Companies can do a lot to change that.

But that’s not all. The path to retirement is long, unpredictable, and filled with challenges. On top of the current cost-of-living crisis, they have to figure out paying for education, securing a place to live, facing overwhelming debt and health care costs. Employees keep facing these challenges, but they are left to grapple with them on their own.

Conclusion

The key reason employees spend close to one-third of their lives working is so that they can be financially secure. Along with work hours, they are investing their energy, creativity, commitment, and sense of purpose. But, are they getting enough in return?

Finances are intertwined in the daily, social, and family life of employees. Their financial health, or lack of it, is closely tied to their mental and physical health; to reaching their life goals and dreams. All of which can be improved with better financial care in the workplace.

About the survey

The survey of 1,000 full-time employees in the U.S. was conducted online, from October 3-5, 2022. The respondents were from four age groups, with 250 respondents from each: Gen Z (18 – 25), Millennials (26 – 41), Gen X (42 – 56), and Baby Boomers (57 – 76). Forty-six percent of the respondents were male, and 54% were female. The topic of the survey was financial wellness programs at work.

Research team

Ana Casic (TalentLMS), Christina Pavlou (TalentLMS), Kris Alban (Enrich), Alex Gostomelsky (Tapcheck)

Jump right in with

ready-made courses

TalentLibrary™: Ready-made training for real-world skills

Bring out the best in your teams.

Get started with the most versatile and affordable employee training platform, no credit card needed.