Financial stress is more than a personal problem. It’s a business one, too.

Financial anxiety, also known as money worries, is one of the biggest killers of productivity, innovation, and motivation. When multiplied across a team, it becomes a quiet drag on the entire company’s creative momentum.

While many people think just having more money could solve all their financial worries (or even an unexpected financial shock), the reality is that true financial wellness is about control, not just income.

Instead, it’s tied to having a functional plan for your money. An employee with strong financial wellness tools knows where their money is going, saves for future financial goals without stress, and isn’t derailed by an unexpected car repair or medical bill.

Helping your employees build that plan is a direct investment in your company’s focus. By fostering employee financial wellness, you get a team that’s mentally present, financially stable, and fully equipped to drive the business forward.

Why financial wellness matters to employees

Financial wellness is important to employees.

Financial stress isn’t a problem they can leave at the door. It’s a persistent, low-grade anxiety that follows them into meetings, disrupts their sleep and mental health, and shadows them throughout the workday.

Financial stress fundamentally changes a person’s emotional state. It erodes their sense of security and confidence, replacing it with a constant, nagging anxiety that colors every decision and interaction, both at work and at home.

Living under this continuous pressure puts people into a state of “survival mode.” It narrows their focus to simply getting through the next day or paying the next bill, making it nearly impossible to think about long-term goals, contribute creatively, or fully engage with their life and work.

According to TalentLMS’s research on financial wellness, 77% of employees say that financial wellness benefits are important to them, signaling a clear demand for support from their employers.

Why organizations should prioritize employee wellness

Prioritizing employee financial wellness offers a number of strategic advantages.

It boosts talent retention and attraction

The revolving door of employee turnover is one of the most significant and controllable costs any business faces, draining resources, disrupting teams, and forcing a constant, expensive search for replacements.

A lack of meaningful financial well-being support for employees is often a key reason that door keeps spinning. In fact, the same TalentLMS research also supports this by showing that 68% of employees are more likely to stay with a company that offers these benefits.

Providing financial wellness programs acts as a powerful countermeasure, sending a clear signal to current and future talent that the organization is invested in their long-term stability.

It drives productivity and focus

The most insidious cost of financial stress is “presenteeism,” where an employee is physically at their desk but their mind is consumed by money worries. The resulting lack of focus directly erodes their ability to solve problems, innovate, and perform critical tasks.

Based on PwC survey data reveals that nearly half (47%) of employees are worried about their finances. Plus, 44% of financially stressed employees report being distracted at work due to this.

Strong employee financial wellness programs directly reclaim lost productivity. It replaces financial anxiety with a clear plan and confidence, freeing up the mental bandwidth required for deep focus and creative problem-solving.

It enhances your employer brand

An employer brand is not built by marketing campaigns but by the lived experiences of its employees. What your people say about you to their friends, families, and professional networks is the most authentic and powerful branding you have.

Investing in your team’s financial well being with financial wellness initiatives like financial support turns them into your most effective brand ambassadors. A survey from the American Psychological Association revealed that 89% of employees are more likely to recommend their company if the company supports well-being initiatives.

It reduces stress and lifts workplace culture

A workforce operating under a cloud of financial anxiety often fosters a culture of low trust, irritability, and risk aversion. An atmosphere of pervasive stress makes genuine collaboration and innovation nearly impossible and heavily impacts financial health.

Addressing financial stress is a critical component of supporting the importance of employee wellbeing, as it directly changes the emotional fabric of your workplace.

That single emotional shift is the foundation for a healthier and more resilient culture, creating an environment where employees feel safe enough to take smart risks and engage fully with the company’s mission.

It advances your Diversity, Equity, and Inclusion (DEI) Goals

Employee financial wellness is fundamentally an issue of equity because financial stress never lands the same way on everyone. A younger employee grappling with student debt faces a completely different reality than a senior colleague planning their retirement.

The data reflects this disparity, showing that adults aged 30-44 are nearly twice as likely as those over 60 to feel their financial situation is holding them back in life.

When a benefits package ignores these distinct life stages and challenges, it unintentionally reinforces inequity. A one-size-fits-all approach simply cannot work.

In contrast, well-designed financial wellness programs function as a powerful tool for equity. It confronts these disparities directly with targeted support, creating an environment where every employee gets a fair chance to thrive.

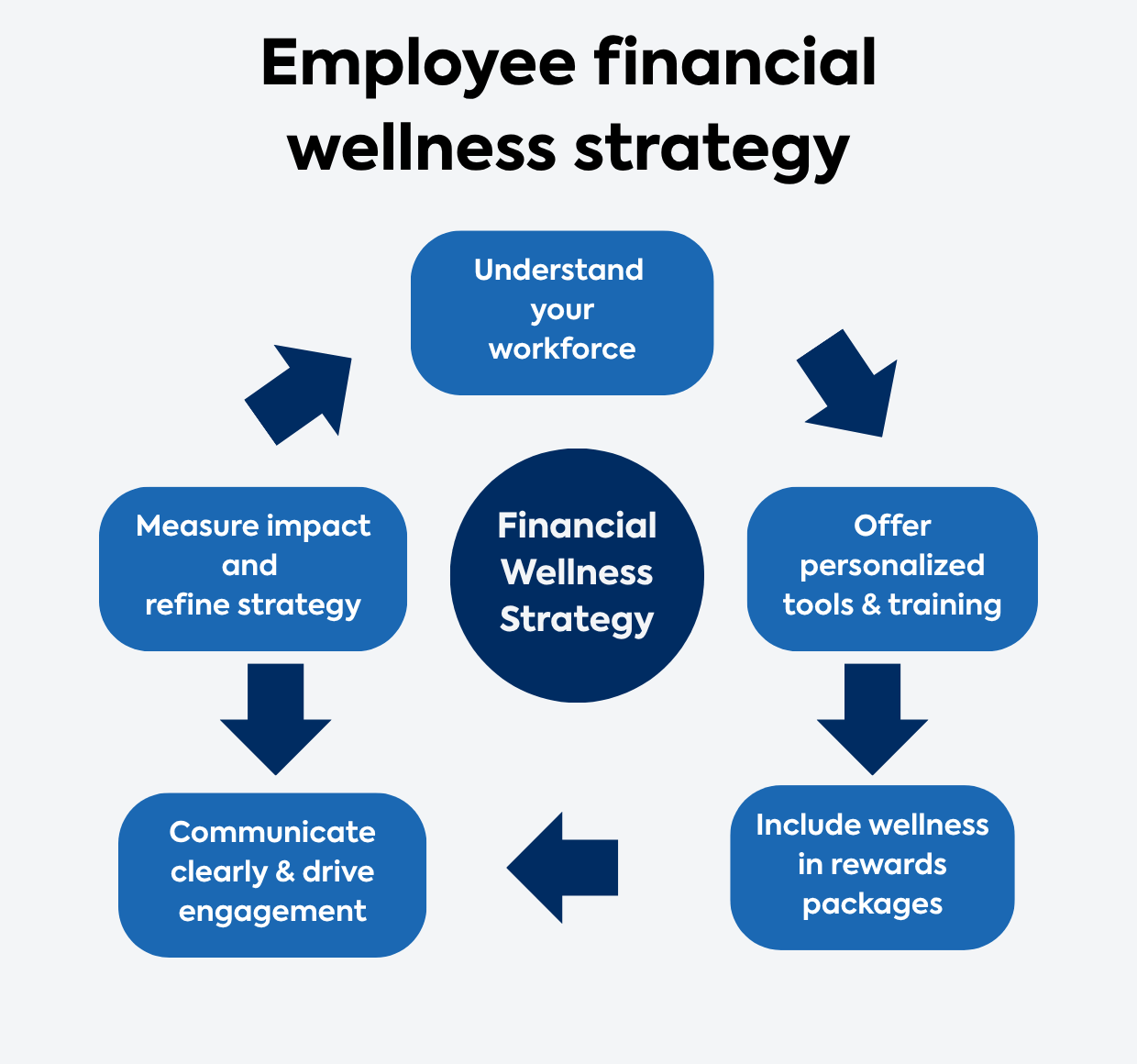

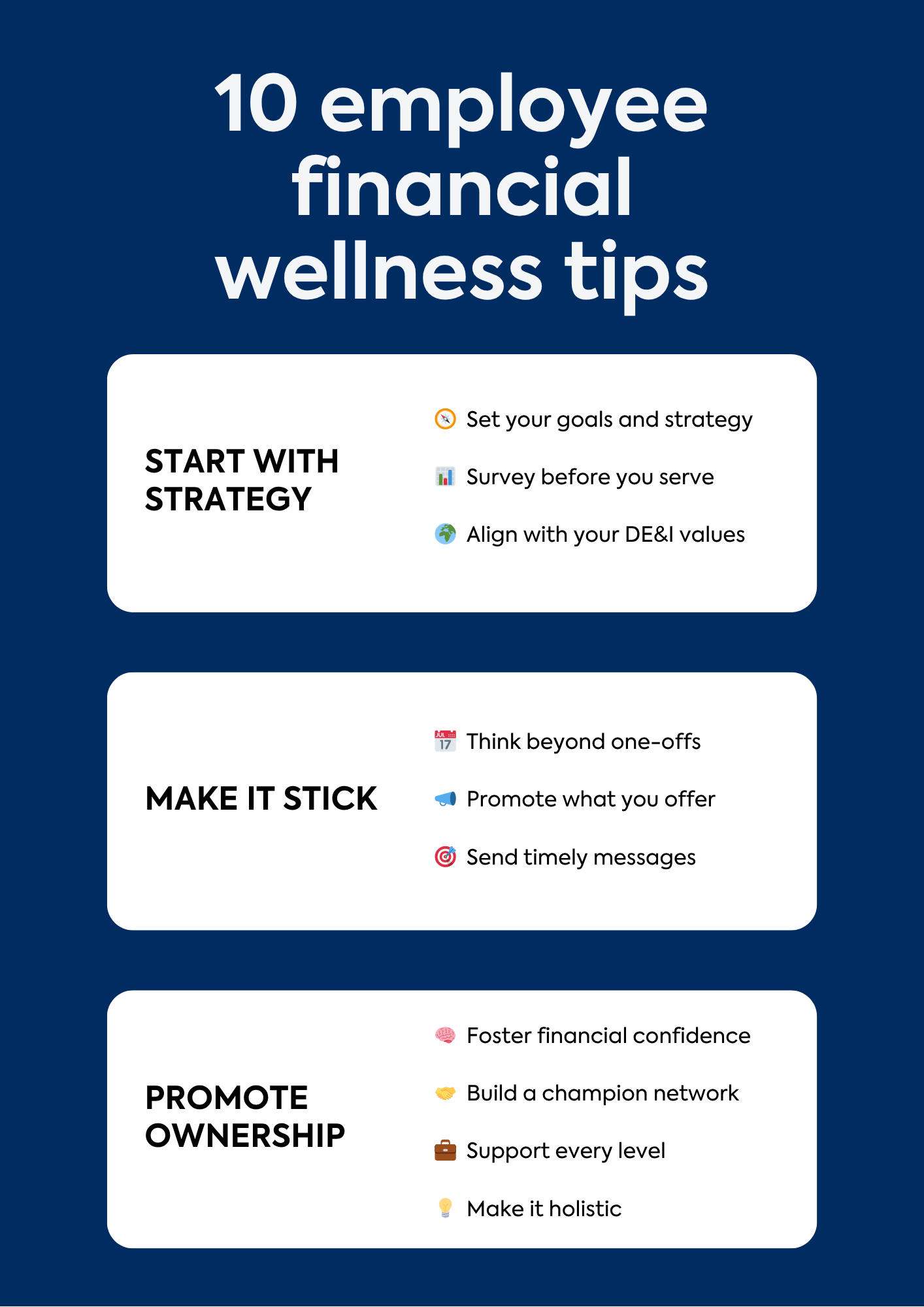

5 steps to developing a financial wellness strategy in the workplace

The difference between an employee financial wellness program that succeeds and one that fails often comes down to its strategic design.

Building an employee assistance program for financial wellness requires a focused commitment to a few key areas, which form the foundation of any successful financial wellness strategy.

1. Start by understanding your workforce

As mentioned, the most effective programs are built on a deep understanding of your employees’ actual needs, which you can gather without making major investments.

Start by deploying brief, anonymous surveys to ask directly about their biggest financial stressors. Supplement that with insights from anonymized aggregate data you already have, like 401k loan rates or hardship withdrawals, to identify underlying patterns.

The plan you create from this first data-gathering effort makes sure you are building a program that will be useful to employees.

2. Offer personalized tools, financial coaching and ongoing training

Once that blueprint is clear, the next step is to offer personalized resources that cater to a diverse workforce. A program must cater to a 25-year-old managing student debt just as effectively as a 55-year-old maximizing retirement savings.

A strong menu of resources should include financial coaching for sensitive debt issues, group workshops for major milestones like home buying, and a library of on-demand digital tools for self-paced learning on key personal finance topics.

Offering this range of options gives employees the autonomy to find the right support for their specific situation, which builds trust and can encourage employees to participate.

TalentLibrary – Skills that matter, courses that deliver

With TalentLibrary, you set the foundation for a strong, aligned workforce—soft skills, compliance, and workplace essentials, from day one (and beyond).

3. Make financial wellness part of your total rewards package

Financial wellness shouldn’t sit in a silo. When it’s woven into the rest of your benefits, it helps employees make smarter use of everything you offer and boosts the overall value of your rewards program.

Think: a budgeting session that helps employees free up money for their 401(k), or a quick guide on how to use their HSA effectively during open enrollment. It’s about giving people the tools to connect the dots between financial confidence and long-term benefits.

4. Communicate clearly and drive engagement

Even the best-designed program will fail without a thoughtful communication plan to normalize the conversation around financial health.

Securing visible support from the top is the first step, as a launch message from a senior leader sends a powerful signal that the company is serious about this initiative.

From there, use a multi-channel approach with emails, intranet posts, and reminders in team meetings to ensure the message reaches everyone.

To keep the program relevant long after the launch, frame ongoing communications around common life events, like getting married or having a child.

5. Measure your impact and refine the strategy

To ensure the strategy remains a living part of your culture, you must demonstrate its value and secure long-term support from leadership. Demonstrating this value requires tracking both engagement metrics, like webinar attendance, and more telling outcome metrics, like shifts in 401k contribution rates over time.

A continuous loop of data collection and analysis serves a greater purpose than a simple report, providing the crucial insights you need to refine and improve the strategy and ensuring its lasting benefit to both your employees and the business.

Invest in your most valuable asset. Your people.

Businesses readily invest millions in the best technology, the most efficient software, and the most advanced infrastructure.

Yet, those powerful assets are only as good as the focused, creative, and engaged human minds tasked with operating them. Your workforce is the company’s most valuable and most sensitive operating system.

Financial stress acts as a persistent drag on that system. It consumes cognitive bandwidth, slows down processing speed, and prevents the kind of innovative thinking required to move the business forward.

Viewing it through this lens, an employee financial wellness program is a strategic investment in the health and performance of your company’s core engine.

Supporting your people’s financial freedom is how you remove the drag, unlock their full potential, and make your entire enterprise run at its best.

Originally published on: 30 Dec 2021 | Tags: Employee financial wellness